GSTR Integration

GSTR integration refers to the process of integrating GST reporting and compliance into a business’s financial and accounting systems. This can involve setting up systems to track GST liability and ensure that the correct amount of tax is being collected and reported. GSTR integration is important for businesses in India because it helps ensure that they are in compliance with GST regulations and reduces the risk of penalties for non-compliance. It also helps businesses accurately track their GST liability and optimize their tax planning strategies.

There are many software available with GSTR integration, including accounting software and GST compliance software. These solutions can help businesses automate the process of tracking and reporting GST liability, reducing the risk of errors and making it easier to comply with GST regulations.

About SAP ERP Integration with GSTR

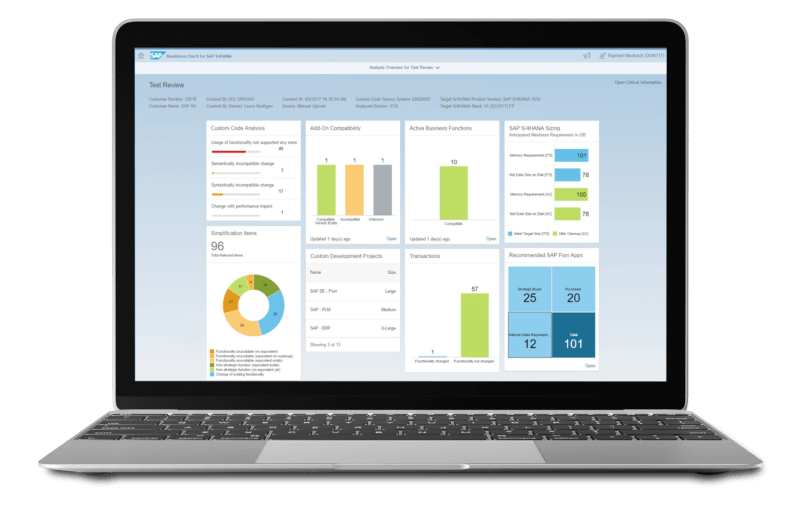

Manage customer invoices, vendor reconciliation, e-filing GST returns, and so much more, all in one place! This SAP Certified GSTR Integration is everything you’ll need for smooth operations and easy setup. With this GSTR Integration, you get access to reports, vendor reconciliation, input service delivery, error logs and validations with a personalized dashboard.

If you are looking to integrate your SAP ERP (Enterprise Resource Planning) system with the GSTR system, there are a few steps include:

Determine the type of integration :

There are several types of integration that implement between SAP ERP and GSTR, including real-time integration, batch integration, and manual integration. Choose the type of integration that best meets your needs.

Set up the integration:

Depending on the type of integration you have chosen, we need to set up the necessary infrastructure and configurations to enable the integration. This may involve setting up APIs, web services, data exchange platforms, or other technical components.

Test integration:

Once the integration has been set up, it is important to test it to ensure that it is functioning correctly and that data is being exchanged accurately between SAP ERP and GSTR.

Go live:

When you are satisfied that the integration is working as expected, you can go live with the integration and start using it in your business operations.

Our SAP consultant and integration specialist ensure that the integration is configured correctly for you.

Benefits of

SAP ERP Integration with GSTR

Purchasing in bulk

Support for multiple GSTINs

Uninterrupted invoicing

Failed invoices are automatically retired

Government compatible APIs

Integrated platform

GSTR Integration: Who is Eligible?

Why Choose PTS?

Across 20+ industry verticals, we help over 150+ customers do business more efficiently and profitably.