E-Way Bill Integration

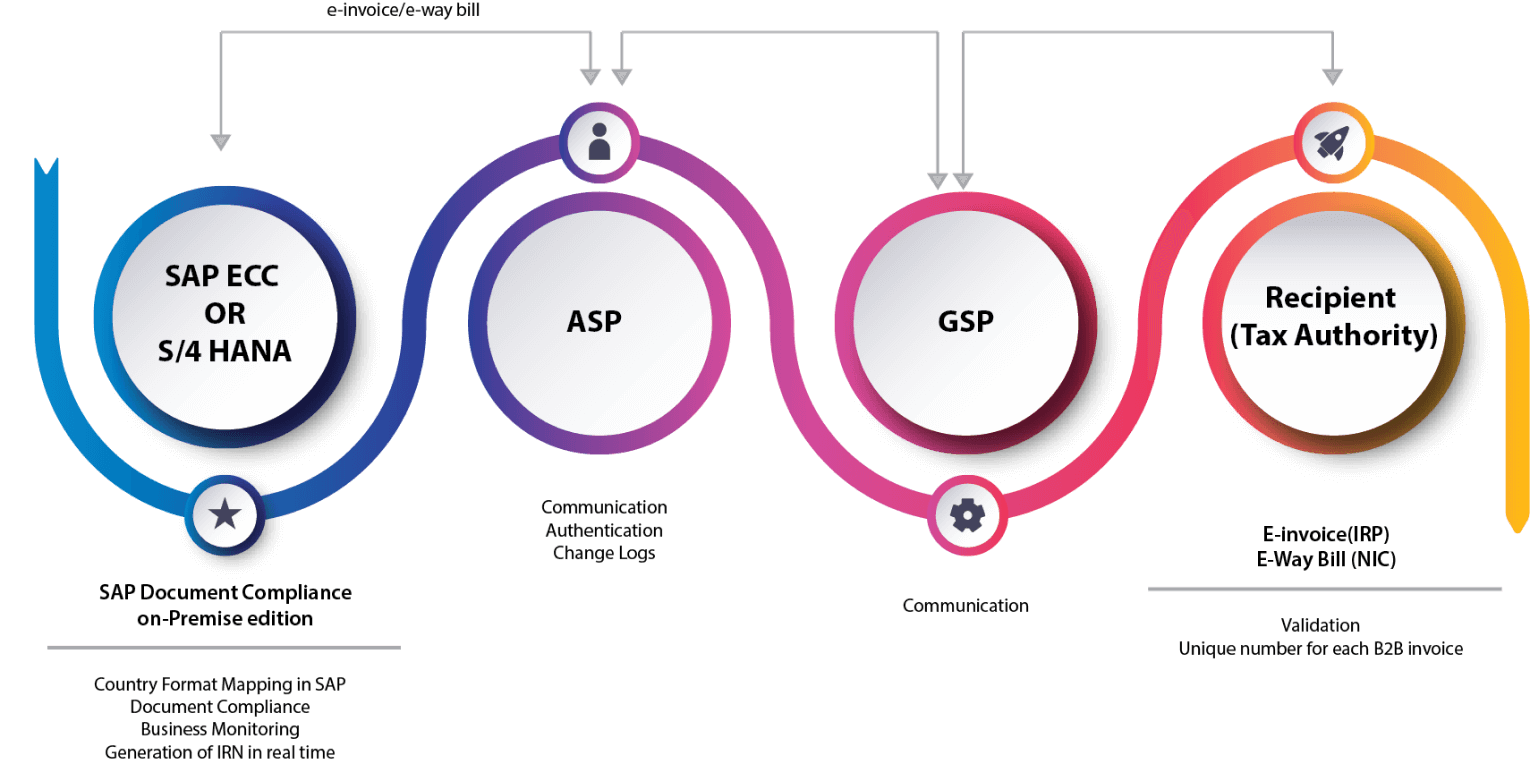

The National Informatics Centre (NIC) portal generates an e-way bill, which documents the movement of goods. SAP E-Way Bill for service providers in India is a business application. SAP Cloud Platform Integration can be used to link the SAP E-Way Bill system to the government’s NIC E-Way Bill system. This e-way bill integration happens via GSP (GST Suvidha Provider).

About E-WAY BILL

An e-way bill is an electronic document that businesses must generate for the movement of goods valued at more than INR 50,000 (Indian Rupees) in India. It is used to record the details of the goods being transported, the vehicle carrying the goods, and the route of the transportation. The e-way bill is generated using the GST (Goods and Services Tax) portal. Also it is required to be carried by the person transporting the goods.

Both e-invoices and e-way bills are electronic documents that are used in the process of conducting business transactions. They both fall under the category of electronic documents used in commerce and trade.

E-Way Bill Integration with SAP

This system allows businesses to generate and manage E-Way Bills electronically, streamlining the process and reducing the risk of errors. It is a business application that allows service providers in India to create E-Way Bills. With SAP Cloud Platform Integration, the SAP E-Way Bill system can be integrated with the government’s NIC E-Way Bill system. GST Suvidha Provider (GSP) integrates e-way bills.

Features of E-Way Bill

- Creating an e-way Bill is simple and quick.

- E-way Bill system that really is easy to use

- Taxpayers and carriers do not need to go to any tax officials or checkpoints in order to generate an e-way bill or move products across states.

- Because there are no checkpoints in the GST regime, there is no wait time at checkpoints resulting in speedy movement of goods and optimal utilization of vehicles/resources.

Benefits of SAP ERP Integration with GSTR

Integrating SAP ERP with GSTR can help businesses in India streamline their GST compliance processes, improve the accuracy of their GSTR forms, and make better data-driven decisions.

By integrating SAP ERP with GSTR, businesses can automatically populate their GSTR forms with data from their financial and accounting systems. This can help reduce the risk of errors and improve the accuracy of the GSTR forms.

Improved accuracy

Integration can help streamline the process of preparing and filing GSTR forms, as data can be automatically pulled from SAP ERP into the GSTR forms. This can save time and resources and reduce the burden of manual data entry.

Streamlined process

Integration can help ensure that businesses are in compliance with GST regulations and can reduce the risk of penalties for non-compliance.

Enhanced compliance

By integrating SAP ERP with GSTR, businesses can access real-time data about their GST liability and use this information to inform their decision-making and optimize their tax planning strategies.

Better decision-making

Contact Us for an Excellent E-way Bill Integration With SAP

PTS Systems and Solutions has extensive experience in managing global projects and ERP life cycle implementations. We have recently released a new SAP Certified E-Invoicing Integration Add-On that allows companies to automatically report e-invoices to the government portal and file GST returns. This add-on creates data per the Goods and Services Tax (GST) Council’s regulations. To know more about our E-way bill solutions, get in touch with us today!