E-invoice Integration

Your One-stop SAP Solution for

All Your e-invoicing & E- way Bill Needs

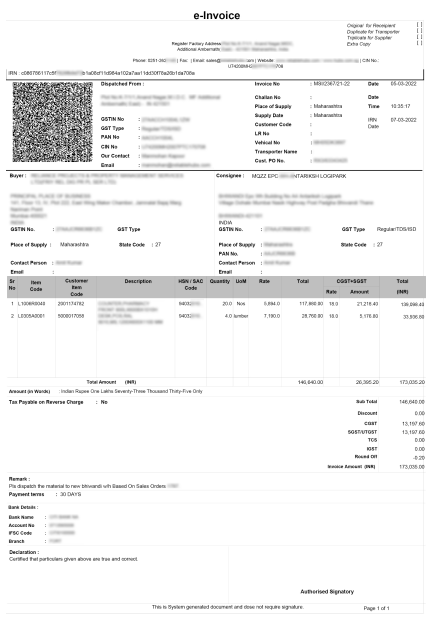

With the digital transformation sweeping across industries, integrating e-invoicing into your business operations is no longer just an option but a necessity. It serves as a tool for eliminating tax evasion and data duplication by digitizing the entire invoicing process. Any invoice posted on the Governmental portal will be subject to GSTN approval under e-invoicing.

E-invoicing, or electronic invoicing, enables you to send and receive invoices electronically, eliminating the need for paper-based invoicing. By automating the invoicing process, businesses can reduce errors, accelerate payment cycles, and improve cash flow. Streamlining invoice processing saves time and resources, allowing your team to focus on more value-added tasks.

Furthermore, integrating e-invoicing can enhance visibility into your financial data, providing real-time insights into cash flow and payment status. Armed with this information, you can make informed business decisions and effectively manage your finances

Is your business ready to move to e-invoicing by August 1, 2023?

From 1st August 2023, e-Invoicing will be mandatory for businesses with an aggregated turnover of more than INR 5 crore.

The Benefits and Advantages of E-Invoicing Integration

E-invoicing Software Solution

We have recently released a new SAP Certified E-Invoicing Software Solution Add-On that allows companies to automatically report e-invoices to the government portal and file GST returns. This add-on creates data in accordance with the Goods and Services Tax (GST) Council’s regulations. As a result, needless paperwork, manual labour, bugs, and delays are eliminated.

Easy-to-Use System Applications to Generate e-invoice & e-Way Bill in Seconds

API based

Offline tool based

GSP based

Key Features of E-Invoice Integration

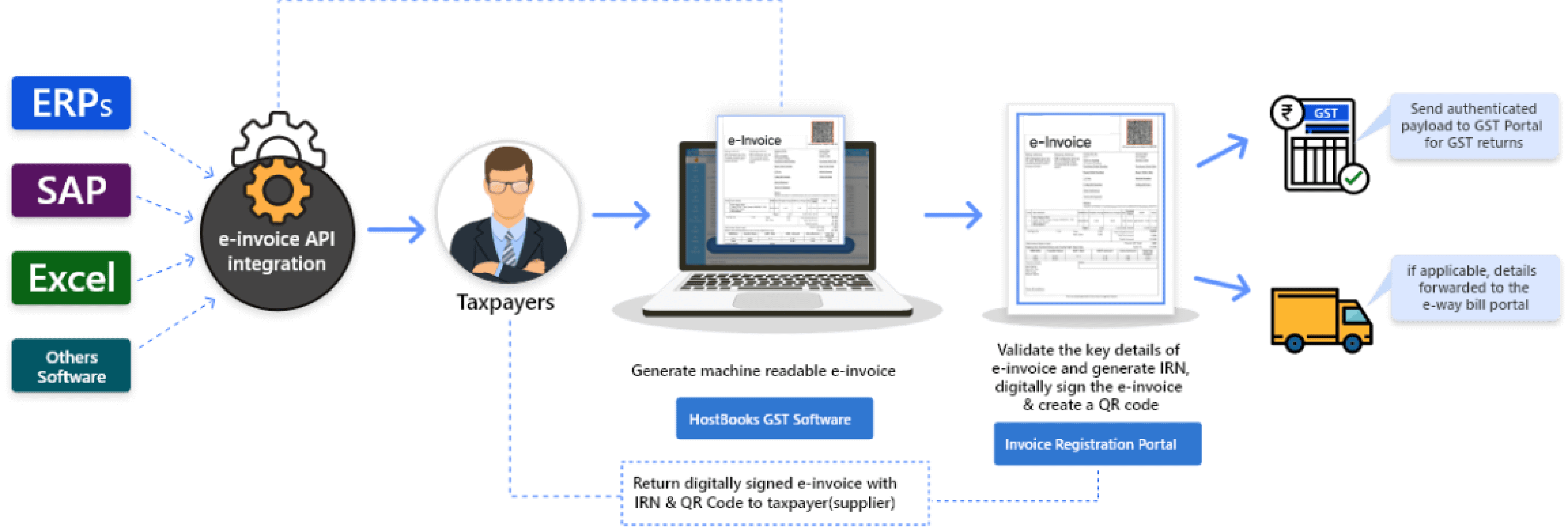

How E-Invoicing Integration Works

E-invoicing integration involves the seamless exchange of electronic invoices between your business and your customers or suppliers. The process typically involves the following steps:

Invoice Generation

Instead of creating paper invoices, you generate electronic invoices using specialized e-invoicing software or platforms. These invoices are created in a standardized electronic format, making them compatible with various systems.

Invoice Delivery

Once the electronic invoices are generated, they are delivered to your customers or suppliers electronically. This can be done through email, secure file transfer protocols, or electronic data interchange (EDI) systems.

Invoice Approval

After the invoices are matched and verified, they go through an automated approval process. This process can be customized based on your business rules and workflows, ensuring compliance and control.

Invoice Receipt

Upon receiving the electronic invoices, your customers or suppliers process them in their own e-invoicing systems. The invoices are automatically matched with the corresponding purchase orders or contracts, ensuring accuracy and reducing the chances of errors.

Payment Processing

Once the invoices are approved, the payment process is initiated. E-invoicing integration allows for seamless integration with your accounting and payment systems, automating the payment process and reducing the chances of errors and delays.

Real-time Insights

Throughout the entire e-invoicing process, you have real-time visibility into the status of invoices, payment cycles, and cash flow. This enables you to effectively manage your finances and make informed business decisions.

How e-Invoicing under GST works

Our Clients

Why Choose Us For Your E-Invoice Software Integration?

Let's get you started with E-invoicing to digitally transform your business.

New Updates on E-Invoicing

1st August 2023,

CBIC extended e-invoicing to taxpayers whose turnover is more than Rs 5 crore in any financial year from 2017-18. As a result, these taxpayers must issue e-invoices starting from 1st August 2023.

On 6th May 2023

The GST department deferred the time limit of reporting old e-invoices on the e-invoice IRP portals by three months, but the new implementation date is yet to be announced.

13th April 2023

The GSTN released an advisory stating that taxpayers with an annual turnover of Rs. 100 crore and above must report tax invoices and credit-debit notes to the IRP within 7 days from the date of issue of the invoice/CDN starting from 1st May 2023

E-invoicing Webinar

Don’t miss out on our exclusive webinar where we delve into the fascinating world of GST e-Invoicing and its profound impact on businesses with turnovers exceeding 20 CR. Whether you’re a business owner or a finance professional, this webinar is a must-watch if you’re seeking to navigate the complexities of e-Invoicing under the GST regime. Join us for an enlightening session and gain valuable insights. Hit the play button now and expand your knowledge!

FAQ’s

E-Invoicing Solution, also known as electronic invoicing, has become a necessity. A tool for eliminating tax evasion and data duplication by digitizing the entire invoicing period. Any invoice posted on the Governmental portal will be subject to GSTN approval under e-invoicing.

E-Way Bill is an Electronic Way Bill that is generated on the e-Way Bill Portal for the movement of goods. A GST registered person may not transport goods in a vehicle with a value greater than Rs. 50,000 (Single Invoice/bill/delivery challan) without an e-way bill generated on ewaybillgst.gov.in.

There is no exception for such unique persons with different GSTINs but the same PAN when it comes to e-invoicing.

SEZ developers are not exempt from E-invoicing because the exclusion only applies to SEZ units, hence they must follow the e-invoicing method. Whether this was a prima facie legal error or not may be a question for the government, as could whether the aim was limited to SEZ units or the entire SEZ.

If an invoice is issued to the recipient, e-invoicing is applicable to all supplies, including exports and exempt supplies.

Financial/commercial credit notes without GST are not required to be reported in e-invoicing, only credits and debits issued under Section 34 of CGST/SGST Act need to be reported.

In conculsion when providing a Quick Response (QR) code with an embedded IRN, it is advisable to keep IRN in one’s ERP.

Yes, a QR code is required, and it will be embedded with IRN. Furthermore, such QR code is distinct from B2C QR codes, as B2C QR codes allow customers to pay directly to a supplier’s account via electronic means [e.g., UPI QR code].

The IRP cannot be amended or changed once it is raised.A taxpayer can cancel the GSTR-1 within 24 hours, but if it has been lapsed for over 24 hours then the taxpayer has no other option and needs to go ahead with it. Furthermore, taxpayers can amend the GSTR-1 in the GST portalSuch above situation would result in differences between GST portal and IRP and the same would be flagged and reported to the concerned jurisdictional officer, who would thereafter provide justification on reasonable grounds.

In case of Maharashtra, e-way bill for intra-State movement of goods is not required if value is less than Rs.one lakh. Maharashtra (for movement of Hank, Yarn, Fabric, and Garments for job work, e-way bills are not required irrespective of value – Notification No. 15E/2018-State Tax, dated 29-6-2018).

Within 24 hours of the IRN being generated, an E-Invoice can be cancelled on the IRP. This is primarily due to the IRP servers’ policy of not storing e-Invoices for more than 24 hours. However, if an e-Way Bill for the IRN has already been generated, it cannot be cancelled.